New Home Mortgage

Smart, flexible mortgage solutions for homeowners upsizing, downsizing, or relocating in the GTA.

Powered by Canada’s #1 mortgage brokerage network.

Making a move? Whether you’re upsizing, downsizing, or relocating—getting the right mortgage is key to making it work financially.

As licensed mortgage agents within Canada’s largest mortgage brokerage network, we specialize in helping homeowners unlock smart, flexible financing for their next home. Whether you’re porting your mortgage, accessing equity, or exploring new 30-year amortization options—we’re here to guide you every step of the way.

🎯 Let’s make your next move your smartest one yet.

🔓 Unlock Elite Access

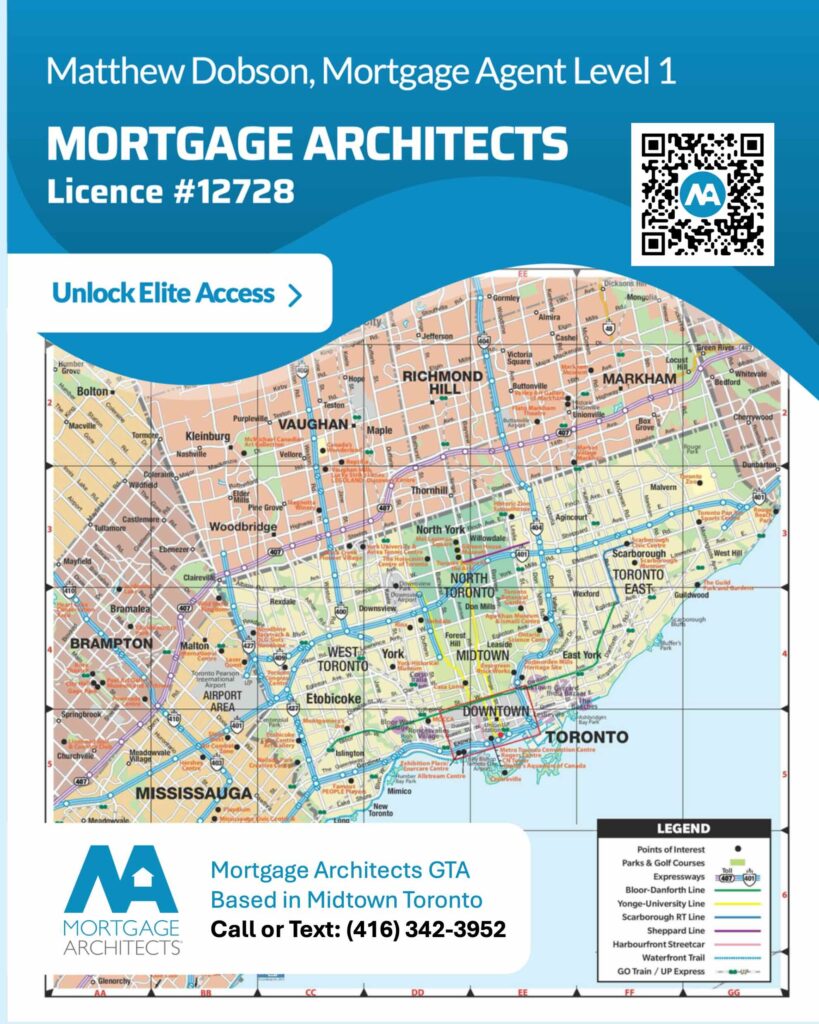

New Home Mortgage in the Greater Toronto Area

💡 Did You Know?

Buying a new home doesn’t have to be complicated—if you understand how to leverage your existing mortgage and equity. As a current homeowner, you may qualify for exclusive lender programs and flexible strategies that make upgrading or downsizing easier and more affordable than you think.

✔ Portability Options – Many lenders allow you to transfer your existing mortgage rate and terms to your next home. This can help you avoid early payout penalties and lock in lower rates in today’s higher-rate environment.

✔ Bridge Financing – Need to buy before you sell? Bridge financing can give you the short-term flexibility to close on your new property without stress or rushed decisions.

✔ New Government Reforms (2025) – You may now qualify for 30-year amortization options, reducing your monthly payments. Plus, if your next home falls within the $1.5M insured mortgage limit, you could secure a low-down-payment mortgage with just 5% down on the first $500K and 10% on the remainder.

✔ Equity Advantage – As a homeowner, you may be able to use the equity in your current home to strengthen your down payment or improve your approval options on your next mortgage.

Whether you’re upsizing, downsizing, or relocating—getting the right mortgage advice can save you thousands and make your move smoother. Let’s explore your options today.

🔓 Unlock Elite Access

Fun Facts About Mortgage Architects & Dominion Lending Centres

A Decade of Strength – Mortgage Architects (MA) was acquired 10 years ago by Dominion Lending Centres Group (TSX: DLCG), the largest mortgage brokerage network in Canada and the #1-ranked mortgage originator with all of the country’s top 10 lenders.

A Trusted Brand – As a prominent brokerage within DLCG, Mortgage Architects has built a reputation for expert guidance, exclusive lender access, and top-tier mortgage solutions.

A True Juggernaut – Founded in 2006, DLCG boasts 8,500+ mortgage professionals across 500+ locations nationwide, funding $62 billion in mortgages annually—a powerhouse in Canadian home financing.

Tech-Driven Excellence – DLCG’s fintech platform, Velocity, revolutionizes the mortgage process by streamlining approvals, making home financing faster, smarter, and easier for Canadians.

More Choices, Better Rates – Our exclusive relationships with major banks, credit unions, and alternative lenders give you access to the best mortgage options tailored to your needs.

A Company That Gives Back – DLCG and Mortgage Architects support local communities across Canada, promoting financial literacy and helping families achieve homeownership.

Our experience and exclusive status work for YOU!

Our Simple, Expert-Guided 4-Step Mortgage Application Process

1️⃣ Get Started: Free Consultation—Contact Us!

2️⃣ Personalized Mortgage Strategy

3️⃣ Pre-Approval & Online Application

4️⃣ Lender Review and Approval

Essential Documents for a Smooth Mortgage Process

Providing all the required documents upfront ensures a smooth and efficient mortgage process. Below is a list of items we may require, depending on your specific situation:

✅ Property Details

To ensure a seamless mortgage application, we may need the following property-related details:

• Agreement of Purchase and Sale

• MLS Listing (if applicable)

• Contact information for your lawyer (name, address, phone, and email)

✅ Personal Identification

• Two pieces of government-issued ID for all applicants

✅ Income and Employment Verification

• Recent pay stub(s)

• Letter of employment (on company letterhead, stating salary, position, and length of employment)

• T4(s) and Notice of Assessment(s) (NOAs) for the last two years (for self-employed applicants)

✅ Down Payment & Financial Information

• Proof of down payment (90-day history of savings/investments)

• Gift letter (if applicable) along with supporting bank statement

• Void cheque or pre-authorized payment form

• Copy of home insurance policy

Additional Requirements: Depending on the property and lender, an appraisal may be required.

What You Can Expect from Us:

At Mortgage Architects, we are committed to understanding your needs today while helping you achieve your long-term financial goals. Our team works diligently to match you with the right mortgage solution. With access to over 50 lending institutions—including major banks, credit unions, and exclusive alternative lenders available only through licensed mortgage agents—we secure the best financing options tailored to your unique situation.

Our Commitment to You:

• We simplify the mortgage process and provide clear guidance every step of the way.

• We advocate on your behalf to get the best possible mortgage terms.

• We stay connected even after your mortgage closes, providing ongoing advice as your financial needs evolve.

Frequently Asked Questions

1️⃣ Can I transfer my existing mortgage to a new home?

✅ Answer: Yes! Many lenders offer mortgage portability, which allows you to move your current rate and terms to your next home—helping you avoid early payout penalties and rising rates.

2️⃣ What is bridge financing and when would I need it?

✅ Answer: Bridge financing is a short-term loan that lets you buy your next home before your current home sells. It helps you close on your new property without rushing to sell or time both closings perfectly.

3️⃣ Can I use the equity in my current home for the new one?

✅ Answer: Absolutely. If you’ve built up equity in your current home, you may be able to use it as a larger down payment or to improve your qualification options for the next mortgage.

4️⃣ Are there new mortgage rules that help move-up buyers in 2025?

✅ Answer: Yes. As of 2025, eligible borrowers can now access:

✔ 30-year amortization options for lower monthly payments

✔ Insured mortgages for homes up to $1.5M, allowing 5% down on the first $500K and 10% on the remainder

These reforms are designed to increase flexibility and affordability for all buyers—not just first-timers.

5️⃣ Should I talk to my bank or a mortgage broker?

✅ Answer: A mortgage broker works with dozens of lenders to find the best rate and strategy for your next move—not just one bank’s offer. We help navigate the details, avoid pitfalls, and maximize your mortgage advantage.

6️⃣ What’s the first step to get started?

✅ Answer: The first step is a quick consultation to review your financial goals, current mortgage details, and next property plans. From there, we’ll outline the smartest path to fund your move.

👉 Let’s get started—book your free mortgage review today!

7️⃣ What are today’s mortgage rates?

✅ Answer: Mortgage rates change daily based on market conditions. We work with Canada’s top lenders to find you the lowest rate available for your situation. Contact us for an up-to-date rate quote tailored to your financing needs.

8️⃣ Do I have to pay fees to work with a mortgage broker?

✅ Answer: In most cases, our services are completely free because lenders pay us when we successfully arrange your mortgage. Our job is to find you the best financing options at no extra cost!

9️⃣ Are Government Reforms Reshaping the Mortgage Landscape in 2025?

✅ Answer: Yes! In the final months of 2024, the Government of Canada and the Office of the Superintendent of Financial Institutions (OSFI) implemented significant mortgage reforms designed to improve borrower flexibility, increase competition among lenders, maintain financial stability and promote housing affordability. Whether you’re a borrower, real estate agent, financial planner, lawyer, or accountant, understanding these changes is essential for navigating the evolving mortgage landscape.

I. Insured Mortgage Cap Increase

To address affordability in high-cost regions like the Greater Toronto Area (GTA), the insured mortgage cap has been raised from $1 million to $1.5 million. First-time buyers can now secure homes with:

• 5% down payment on the first $500,000 of the purchase price.

• 10% down payment on amounts between $500,000 and $1.5 million.

II. Extended Amortizations for First-Time Buyers

First-time buyers and purchasers of new builds can now access 30-year amortizations, significantly lowering monthly payments. This is a game-changer for Millennials and Gen Z, who are entering the market amid economic challenges.

III. Secondary Suite Initiatives (Starting January 15, 2025)

Canada’s Secondary Suite Loan Program

• Borrow up to $80,000 at just 2% interest

• 15-year repayment term

• Perfect for converting basements, garages, or creating laneway suites

Secondary Suite Refinance Program

• Refinance up to 90% of your home’s post-renovation value

• Maximum property value of $2 million

• Amortization periods up to 30 years

IV. Stress Test Removal for Mortgage Switches at Renewal

The removal of the stress test for switching lenders at renewal simplifies the refinancing process, enabling borrowers to shop for better rates without re-qualifying

🔓 Unlock Elite Access

We’re an award-winning team in Toronto, powered by Canada’s top mortgage network—funding more mortgages daily than any bank.

🔓 Unlock Elite Access

Matthew Dobson #M24003077

Mortgage Agent Level 1

Mortgage Architects #12728

c: 416-342-3952

e: md@mortgagearchitectsgta.ca

MA Mortgage Architects Inc.

5675 Whittle Road

Mississauga, ON L4Z 3P6