Luxe Mortgage

Award-winning team for high-value real estate in Toronto.

We are trusted by luxury homeowners across Toronto’s most prestigious neighborhoods.

Luxury real estate deserves luxury lending.

If you’re acquiring a signature estate, a waterfront retreat, or a penthouse in the heart of Toronto—your mortgage partner should match the caliber of your purchase.

We offer white-glove service, elite lender access, and a #1 ranked team that values your time as much as your trust. Backed by Canada’s most powerful mortgage network, we don’t just get deals done—we open doors others can’t.

Unlock Elite Access

Where Prestigious Buyers Meet Canada’s Powerhouse in Luxury Lending

💡 Did You Know?

Toronto is home to some of the most valuable real estate in North America—iconic estates in Bridle Path, grand old homes in Lawrence Park and Forest Hill, timeless charm in Rosedale, and breathtaking penthouses in Midtown and Yorkville. In this world, financing isn’t just about approval. It’s about strategy, access, and execution at the highest level.

Luxe Mortgages are built for this arena—custom mortgage solutions for homes above $1.5 million, tailored to the needs of high-net-worth homeowners, entrepreneurs, and investors.

At Mortgage Architects, you’re not working with a one-person shop—you’re backed by Canada’s largest mortgage brokerage network, representing over $60 billion in annual volume and trusted by top lenders nationwide. From private banking relationships to discreet approvals, you gain elite-level access through a proven institution built to serve clients like you.

🏛️ What Sets Luxe Mortgages Apart:

• Custom Structures Above $1.5M – Designed for multi-million-dollar acquisitions and complex financial profiles

• Net-Worth-Based Lending Options – Qualify using assets, corporate income, or investment portfolios

• No Sliding Scale Limitations – Higher LTV ratios, even on ultra-luxury properties

• Preferred Rate Access – Tap into exclusive pricing through private lending channels

• Expert Strategy & Discretion – Full-service guidance from a white-glove mortgage advisory team

This isn’t about just getting approved—it’s about partnering with a brokerage that operates at the same level you do.

📢 Let’s structure your next Luxe Mortgage with the precision, access, and strategy your property deserves.

Fun Facts About Mortgage Architects & Dominion Lending Centres

A Decade of Strength – Mortgage Architects (MA) was acquired 10 years ago by Dominion Lending Centres Group (TSX: DLCG), the largest mortgage brokerage network in Canada and the #1-ranked mortgage originator with all of the country’s top 10 lenders.

A Trusted Brand – As a prominent brokerage within DLCG, Mortgage Architects has built a reputation for expert guidance, exclusive lender access, and top-tier mortgage solutions.

A True Juggernaut – Founded in 2006, DLCG boasts 8,500+ mortgage professionals across 500+ locations nationwide, funding $62 billion in mortgages annually—a powerhouse in Canadian home financing.

Tech-Driven Excellence – DLCG’s fintech platform, Velocity, revolutionizes the mortgage process by streamlining approvals, making home financing faster, smarter, and easier for Canadians.

More Choices, Better Rates – Our exclusive relationships with major banks, credit unions, and alternative lenders give you access to the best mortgage options tailored to your needs.

A Company That Gives Back – DLCG and Mortgage Architects support local communities across Canada, promoting financial literacy and helping families achieve homeownership.

Our experience and exclusive status work for YOU!

Our Simple, Expert-Guided 4-Step Mortgage Application Process

1️⃣ Get Started: Free Consultation—Contact Us!

2️⃣ Personalized Mortgage Strategy

3️⃣ Pre-Approval & Online Application

4️⃣ Lender Review and Approval

Essential Documents for a Smooth Mortgage Process

Providing all the required documents upfront ensures a smooth and efficient mortgage process. Below is a list of items we may require, depending on your specific situation:

✅ Property Details

To ensure a seamless mortgage application, we may need the following property-related details:

• Agreement of Purchase and Sale

• MLS Listing (if applicable)

• Contact information for your lawyer (name, address, phone, and email)

✅ Personal Identification

• Two pieces of government-issued ID for all applicants

✅ Income and Employment Verification

• Recent pay stub(s)

• Letter of employment (on company letterhead, stating salary, position, and length of employment)

• T4(s) and Notice of Assessment(s) (NOAs) for the last two years (for self-employed applicants)

✅ Down Payment & Financial Information

• Proof of down payment (90-day history of savings/investments)

• Gift letter (if applicable) along with supporting bank statement

• Void cheque or pre-authorized payment form

• Copy of home insurance policy

Additional Requirements: Depending on the property and lender, an appraisal may be required.

What You Can Expect from Us:

At Mortgage Architects, we are committed to understanding your needs today while helping you achieve your long-term financial goals. Our team works diligently to match you with the right mortgage solution. With access to over 50 lending institutions—including major banks, credit unions, and exclusive alternative lenders available only through licensed mortgage agents—we secure the best financing options tailored to your unique situation.

Our Commitment to You:

• We simplify the mortgage process and provide clear guidance every step of the way.

• We advocate on your behalf to get the best possible mortgage terms.

• We stay connected even after your mortgage closes, providing ongoing advice as your financial needs evolve.

Frequently Asked Questions

1️⃣ What qualifies as a Luxe Mortgage in Toronto?

✅ Answer: A Luxe Mortgage refers to financing for properties over $1.5 million, which exceed the insured mortgage threshold in Canada. These mortgages require larger down payments, custom underwriting, and lender relationships designed for high-net-worth individuals, investors, professionals and entrepreneurs.

2️⃣ How much income do I need to qualify for a mortgage above $1.5 million?

✅ Answer: Most lenders require household income between $300,000–$370,000+ with a 20% down payment. But Luxe lending goes beyond simple income—it may involve net-worth-based approvals, corporate financials, or asset-backed underwriting for complex financial profiles.

3️⃣ Can I qualify using business income, investments, or a trust?

✅ Answer: Yes. We structure mortgage applications to reflect total financial capacity, not just personal salary. Lenders may accept corporate income, investment portfolios, or distributions from a family trust as part of your qualifying strategy.

4️⃣ Why are appraisals more complex for luxury homes?

✅ Answer: High-value homes often feature unique architecture, rare materials, or limited comparables. We work with appraisers who specialize in prestigious Toronto neighborhoods like Bridle Path, Forest Hill, and Yorkville to ensure valuations reflect true market value.

5️⃣ How are rates and terms determined for Luxe Mortgages?

✅ Answer: Luxe lending is not one-size-fits-all. Your mortgage rate and structure are custom-tailored based on property value, financial strategy, and lender alignment. We provide discreet consultations to access preferred rates and termsthrough Canada’s most exclusive lending network.

6️⃣ Can international buyers or new Canadians qualify?

✅ Answer: Yes. International buyers are eligible with 35–50% down, verified global income, and Canadian banking relationships. We have direct access to cross-border lenders and private lenders who specialize in global wealth management.

7️⃣ How does Toronto’s luxury land transfer tax affect closing costs?

✅ Answer: Properties over $3 million are subject to progressive Municipal Land Transfer Taxes, up to 7.5% on amounts exceeding $10M. We guide you through these costs and, where possible, structure deals to optimize closing liquidity.

8️⃣ Can I finance multiple luxury properties or structure a portfolio mortgage?

✅ Answer: Yes. We offer portfolio lending solutions for clients with multiple high-value properties. These provide consolidated approvals, preferred pricing, and debt strategy alignment—ideal for investors, business owners, or multi-generational buyers.

9️⃣ What if my property is non-traditional—heritage, rural, or uniquely built?

✅ Answer: We specialize in non-conforming luxury real estate, including heritage homes, waterfront estates, and rural properties. Our lender network supports custom property assessments and bespoke structuring to secure financing for exceptional homes.

🔟 Why choose Mortgage Architects GTA for my Luxe Mortgage?

✅ Answer: We are part of Canada’s largest mortgage brokerage, representing over $60 billion annually and trusted by 50+ lenders across the country. Our white-glove service, strategic access, and elite partnerships ensure your mortgage is handled with the same level of expertise you expect from your private banker or investment advisor.

We save you more than money—we save your time.

Tailored mortgage strategies from Toronto’s award-winning team at Canada’s #1 brokerage.

Schedule your private consultation.

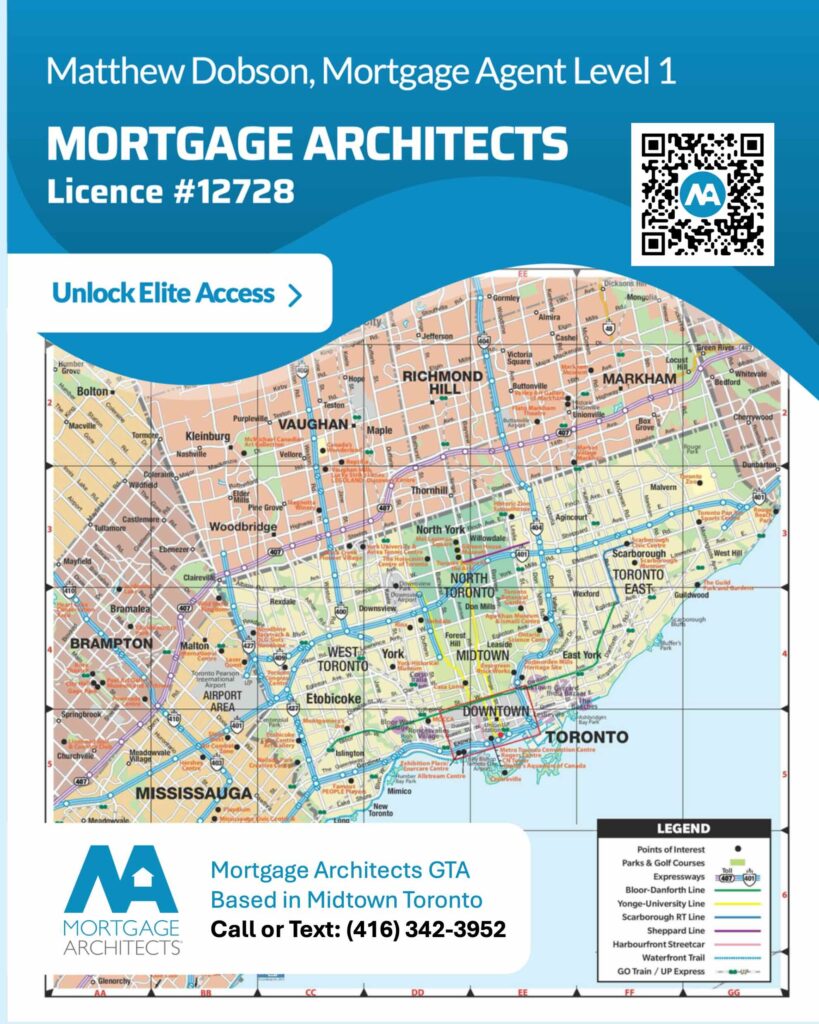

Matthew Dobson #M24003077

Mortgage Agent Level 1

Mortgage Architects #12728

c: 416-342-3952

e: md@mortgagearchitectsgta.ca

MA Mortgage Architects Inc.

5675 Whittle Road

Mississauga, ON L4Z 3P6