Reverse Mortgage

Stay in your home and unlock up to 55% of its value—tax-free, with no monthly payments.

Expert-guided solutions for financial freedom in retirement.

Powered by Canada’s #1 ranked mortgage brokerage.

Your home is your biggest asset—now it can be your most powerful financial tool.

If you’re 55 or older, a reverse mortgage can help you stay in your home and access tax-free cash—with no monthly payments and full ownership retained. Whether you’re looking to improve cash flow, pay off debt, or support family, our team will guide you through your options with clarity and care.

🎯 Let’s unlock the value in your home—together.

Unlock Elite Access

Reverse Mortgage Solutions in Canada

💡 Did You Know?

Your home could be the key to unlocking financial freedom in retirement. If you’re 55 or older and own your home, you may qualify to access up to 55% of its value—tax-free—without selling or making monthly mortgage payments.

Unlike traditional loans, a reverse mortgage gives you tax-free cash that you can use however you choose:

✔ Pay off debt

✔ Renovate your home

✔ Boost your retirement income

✔ Help your family

✅ You retain full ownership of your home

✅ You can live in it for life

✅ There’s no risk of foreclosure as long as you meet basic property obligations (taxes, insurance, maintenance)

With home values rising across Canada, reverse mortgages have become a popular and powerful tool for retirees. Over 99% of Canadians still retain equity when their home is eventually sold—often gaining from continued property appreciation.

A reverse mortgage isn’t just a loan—it’s a strategy to turn your home equity into financial security, without giving up the place you love.

👉 Let’s explore how much you qualify for—contact me today.

Fun Facts About Mortgage Architects & Dominion Lending Centres

A Decade of Strength – Mortgage Architects (MA) was acquired 10 years ago by Dominion Lending Centres Group (TSX: DLCG), the largest mortgage brokerage network in Canada and the #1-ranked mortgage originator with all of the country’s top 10 lenders.

A Trusted Brand – As a prominent brokerage within DLCG, Mortgage Architects has built a reputation for expert guidance, exclusive lender access, and top-tier mortgage solutions.

A True Juggernaut – Founded in 2006, DLCG boasts 8,500+ mortgage professionals across 500+ locations nationwide, funding $62 billion in mortgages annually—a powerhouse in Canadian home financing.

Tech-Driven Excellence – DLCG’s fintech platform, Velocity, revolutionizes the mortgage process by streamlining approvals, making home financing faster, smarter, and easier for Canadians.

More Choices, Better Rates – Our exclusive relationships with major banks, credit unions, and alternative lenders give you access to the best mortgage options tailored to your needs.

A Company That Gives Back – DLCG and Mortgage Architects support local communities across Canada, promoting financial literacy and helping families achieve homeownership.

Our experience and exclusive status work for YOU!

Our Simple, Expert-Guided 4-Step Mortgage Application Process

1️⃣ Get Started: Free Consultation—Contact Us!

2️⃣ Personalized Mortgage Strategy

3️⃣ Pre-Approval & Online Application

4️⃣ Lender Review and Approval

Essential Documents for a Smooth Mortgage Process

Providing all the required documents upfront ensures a smooth and efficient mortgage process. Below is a list of items we may require, depending on your specific situation:

✅ Property Details

To ensure a seamless mortgage application, we may need the following property-related details:

• Agreement of Purchase and Sale

• MLS Listing (if applicable)

• Contact information for your lawyer (name, address, phone, and email)

✅ Personal Identification

• Two pieces of government-issued ID for all applicants

✅ Income and Employment Verification

• Recent pay stub(s)

• Letter of employment (on company letterhead, stating salary, position, and length of employment)

• T4(s) and Notice of Assessment(s) (NOAs) for the last two years (for self-employed applicants)

✅ Down Payment & Financial Information

• Proof of down payment (90-day history of savings/investments)

• Gift letter (if applicable) along with supporting bank statement

• Void cheque or pre-authorized payment form

• Copy of home insurance policy

Additional Requirements: Depending on the property and lender, an appraisal may be required.

What You Can Expect from Us:

At Mortgage Architects, we are committed to understanding your needs today while helping you achieve your long-term financial goals. Our team works diligently to match you with the right mortgage solution. With access to over 50 lending institutions—including major banks, credit unions, and exclusive alternative lenders available only through licensed mortgage agents—we secure the best financing options tailored to your unique situation.

Our Commitment to You:

• We simplify the mortgage process and provide clear guidance every step of the way.

• We advocate on your behalf to get the best possible mortgage terms.

• We stay connected even after your mortgage closes, providing ongoing advice as your financial needs evolve.

Frequently Asked Questions

1️⃣ What is a reverse mortgage?

✅ Answer: A reverse mortgage is a loan secured against your home that allows Canadians aged 55+ to access up to 55% of their home’s value tax-free, without selling or making monthly payments. You keep ownership and can live in your home as long as you choose.

2️⃣ Do I still own my home with a reverse mortgage?

✅ Answer: Yes! You retain full legal ownership of your home. You are only required to keep the property in good condition and stay current on property taxes and home insurance.

3️⃣ Do I have to make monthly mortgage payments?

✅ Answer: No. With a reverse mortgage, you’re not required to make any monthly payments. The loan is typically repaid when you sell your home, move out, or pass away.

4️⃣ What can I use the funds for?

✅ Answer: The funds are yours to use however you like—from paying off debt, renovating your home, covering medical costs, or helping family. The money is tax-free and does not impact your government benefits like CPP or OAS.

5️⃣ How much money can I access?

✅ Answer: You can access up to 55% of your home’s appraised value. The exact amount depends on your age, the location and condition of your home, and its current market value.

6️⃣ What happens to my home when I pass away?

✅ Answer: Your home will be part of your estate. The reverse mortgage will be repaid from the proceeds of the sale. In most cases, your remaining home equity is passed on to your heirs. Over 99% of Canadians who take out a reverse mortgage still retain equity at the time of sale.

7️⃣ Is a reverse mortgage better than a HELOC (Home Equity Line of Credit)?

✅ Answer: It depends on your situation. A HELOC requires monthly payments and income qualification. A reverse mortgage offers no monthly payments and easier approval, making it ideal for retirees or those on a fixed income.

8️⃣ Will I still benefit if my home increases in value?

✅ Answer: Yes. You still own your home and can benefit from future property appreciation, which can help preserve equity—even after interest is repaid.

9️⃣ Is a reverse mortgage safe and regulated?

✅ Answer: Yes. Canadian reverse mortgages are regulated by OSFI and offered by reputable lenders under strict guidelines. As long as you meet your basic obligations, you can stay in your home for life without fear of foreclosure.

🔟 How do I get started?

✅ Answer: Start with a free consultation to see how much you qualify for. We’ll walk you through your options and help you decide if a reverse mortgage is the right fit for your goals.

We are an award winning team in Toronto and our mortgage brokerage network funds more mortgages every day than any other financial institution in Canada. Let’s work on your choices together!

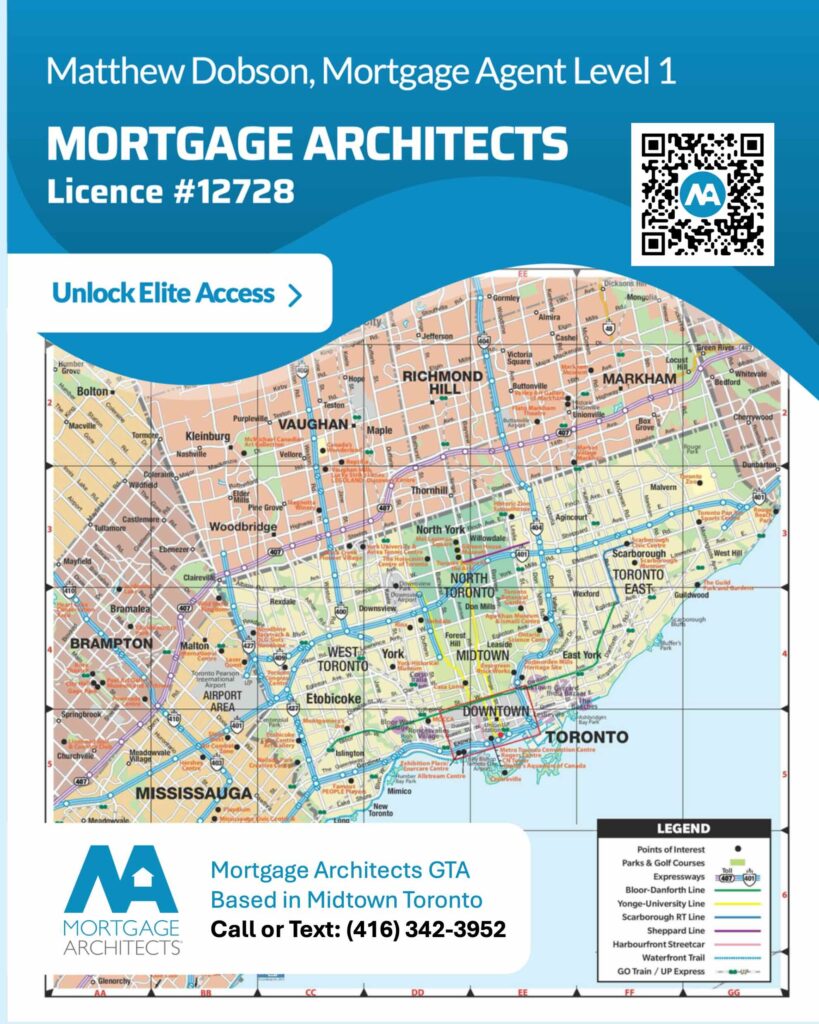

Matthew Dobson #M24003077

Mortgage Agent Level 1

Mortgage Architects #12728

c: 416-342-3952

e: md@mortgagearchitectsgta.ca

MA Mortgage Architects Inc.

5675 Whittle Road

Mississauga, ON L4Z 3P6